Volatility interruption is a protection mechanism preventing abrupt price changes and protection against misplacement of orders. This safety mechanism is used in continuous trading and auction trading procedures.

- What conditions trigger a volatility interruption?

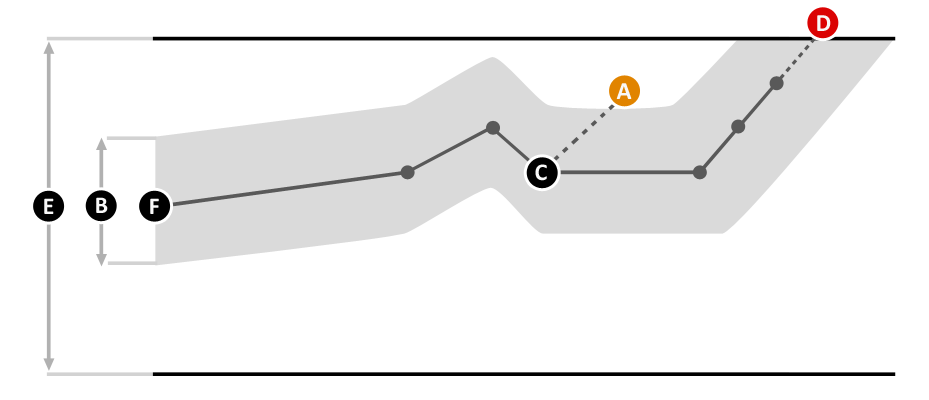

- if an order entry would be executed A with one or more transactions that exceed the predetermined dynamic price limit B. The reference price for the dynamic price limit is the price of the last trade C.

- if an order entry would be executed D with one or more transactions that exceed the predetermined static price limit E. The reference price for the static price limit is the last price determined in an auction F (auction trade session, opening auction, closing auction or volatility interruption). If during a trading day there were no transactions executed during an auction, the reference price is the closing price of the last trading day.

Determination criteria of static and dynamic limits, limit amount and duration of volatility interruption for each type of financial instrument are listed in the Trading Manual.

| Symbol | ISIN | Category | Dynamic Corridor | Static Corridor | Extended Volatility | Static Ref. Price | Dynamic Ref. Price | Min Price | Max Price |

|---|

- Symbol

- Dynamic Corridor

- Static Corridor

Category

- 0

- No Trading Limits

- X

- Trading Limits Exception

- S

- Structured products Class

- E1

- Equity Liquidity Class 1

- E2

- Equity Liquidity Class 2

- E3

- Equity Liquidity Class 3

- E4

- Equity Liquidity Class 4

- D1

- Debt Limits Class 1

- D2

- Debt Limits Class 2

- D3

- Debt Limits Class 3